Our mission is to be a strong political voice on behalf of ambitious startups, scaleups and founders.

Our goals are decided by our members.

How do we make Norway a leading startup nation?

Norway is a country of engineers, with enormous resources tied up in the oil and gas industry. In 2025, investments in oil and gas reached a record high NOK 275 billion. Meanwhile, investments in early stage companies was at its lowest since 2020, with NOK 600 million. The world's largest and leading companies work with big tech, and as an engineer nation, we are well positioned to compete internationally.

We are lagging behind, and need to catch up.

The European Commission launched the EU Startup and Scaleup Strategy in 2025. They are now joining forces with private investors to set up a multi-billion Scaleup Europe Fund. Their slogan is “the best of Europe choose Europe”, to turn the trend where 30% of European unicorns relocated outside Europe, while only 8% of the world’s scale-ups, actually are in Europe.

Ursula and the EU read the Draghi report, and took action. In 2026, Norway must to do the same.

We need to tax for growth

Norwegian startups and scaleups compete internationally with companies from around the world. We need to grow companies based in Norway, with Norwegian ownership, and that should be the obvious choice for Norwegian founders. To achieve that, it needs to be the obvious choice from a competitive perspective. The financial framework needs to endorse this competitiveness.

Take action

Adjust the net wealth tax to not affect startup and scaleup companies

Adjust the exit tax

Introduce a more ambitious option scheme

Expand KapitalFunn

Increase government investments through Fund-of-Funds (FoF)

Read more on the actions and effects below.

We need to attract talent to Norway

If we want to be competitive on an international scale, our companies are dependent on top talents from around the world. Startups and scale-ups typically coin themselves as “born global”, meaning they have a global mindset even with two employees. To ensure you have the resources needed to scale, sell, adapt and grow, you need to be able to hire globally. You also need to be able to move around globally – as a founder and often top management, you need to be flexible as to where you live for periods of time.

“I am trapped behind a financial “Berlin Wall.” I cannot leave the country for any reason, whether to scale my company internationally, work for another organization, pursue further studies, or for any other personal or professional purpose. If I do, I will end up losing access to all my savings and falling into unmanageable multi-million debt.”

Øystein Skotheim, Head of R&D in ScoutDI AS and co-founder of Zivid AS cited to Dagens Næringsliv

Change the exit tax

Today, you are subject to exit tax if you move abroad with a certain amount of assets. This applies to the increase in value of your assets up to the point of moving. Although most NAST members are happy to pay their taxes, the Norwegian exit tax has some unfortunate effects, making it impossible to pay at times and difficult to navigate.

Take action:

Make an exemption for foreign talent working in Norwegian companies for less than 10 years

Match the tax on dividends (also when tax was deferred) to the national tax rate on gains and dividends (38%). This would prevent the possibility of being taxed more than 100% where the local tax rate comes on top of today’s rate (70%)

Adjust the exit tax for value changes after relocation to prevent unrealized gains from taxation

Make the exit tax on unlisted shares payable only upon tax realization or listing, and remove the 12-year rule

Make an exemption for foreign pension savings

Improve the stock option scheme

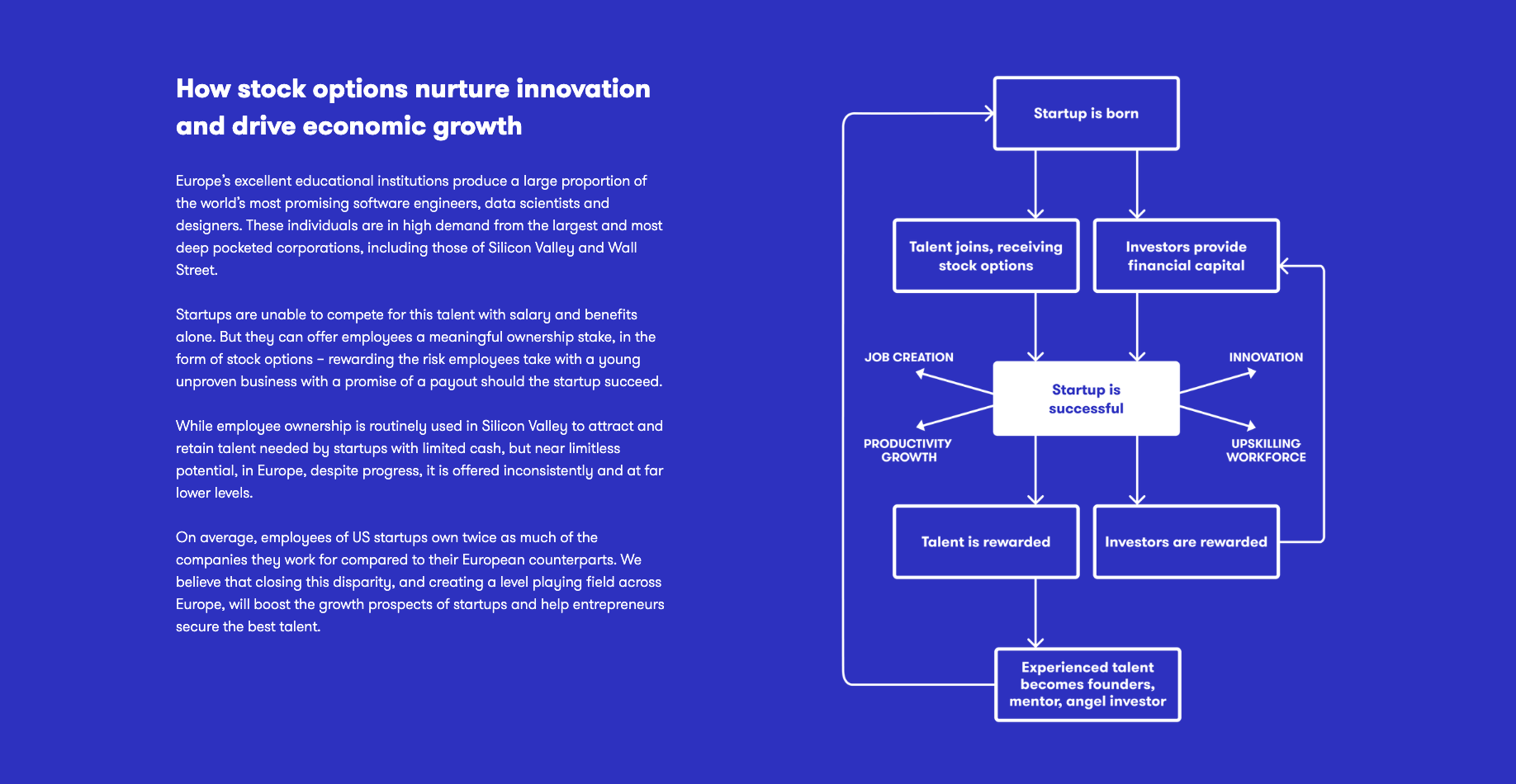

A promising company starting out often has an abundance of ambition, enthusiasm and energy. What it lacks, is cash. Norway is a country with lucrative job options for engineers, making it difficult for small and young companies to compete for their employment. A strong and ambitious option scheme can correct this imbalance and give more tools to founders starting out.

This illustration is shamelessly copied from notoptional.eu, who ranks Norway second to last of 20 European countries and their option schemes.

The option scheme for startups and scaleups in Norway has been improved on the last years, which is great. This is a tool that companies use and appreciate. Once you reach a certain limit, however, with number of employees, revenue, time or value, your company is no longer able to use issue stock options. Often, this is when you need the incentives the most.

Take action:

Include companies with up to 1000 employees (or remove the limitation all together like the Baltic states)

Include companies with up to NOK 10 billion in revenue (or remove the limitation all together like the Baltic states)

Include companies up to 20 years

Increase the cap on a companies market value on stock options to NOK 500 million

Increase the individual limit to NOK 20 million

Increase the share of stocks employees can own to 25%, independently of previous years

We need to attract capital to Norway

The startup sector is dependent on high risk capital for investments. Even great ideas stay ideas if no one invests in realizing them. The EU knows this, and in 2025, Ursula von der Leyen and the European Commission has initiated the Scale up Europe fund of $5 billion. We need to grow European technology businesses, or have complete dependency on other regions.

As one of the world’s largest investor, Norway is in a unique position to do more. As a small first step, the government should provide more risk capital for the funds who need it to build the Norwegian venture scene.

Today, personal taxpayers can claim a deduction from their general income of up to NOK 1 million per year for share contributions to start-up companies. This is a good incentive for individuals to invest in high risk projects, but it can be more ambitious.

Take action:

Increase government investments through Fund-of-Funds (FoF)

Expand the existing KapitalFunn-arrangement to give 50% income deduction for investments in startups up to NOK 2 million yearly, and 30% income deduction for investments in scaleups up to NOK 10 million yearly (in line with the SEIS and EIS schemes in the UK)

Adjust the net wealth tax to not affect startup and scaleup companies